U.S. Online Travel Spending Rebounds

While we tend to focus much of our attention on retail e-commerce spending trends as a gauge of the U.S. consumer economy, it can be easy to overlook another important sector of e-commerce: online travel. Though it no longer drives the majority of online spending, it still amounts to $80 billion annually, or about 40% of total e-commerce.

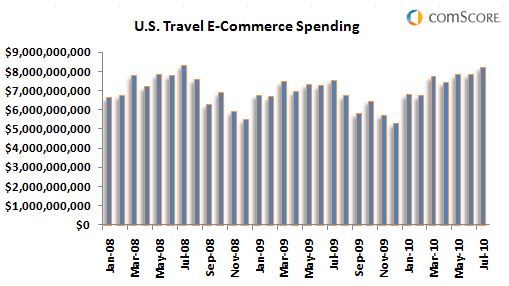

Comscore’s estimate of U.S. online travel spending – which primarily accounts for consumer and small business travel spending – reached $8.2 billion in July 2010, representing the second highest month on record. (July 2008 still holds the record at $8.3 billion.) July was also the fifth consecutive month where online travel spending eclipsed $7 billion, indicating sustained strength in the sector.

This strength is also evidenced in the Y/Y growth rates, where online travel spending growth reached 9% in July, representing the seventh consecutive month of gains. This is quite an achievement, considering this streak comes on the heels of eleven consecutive months of negative growth rates in 2009. At its nadir, which came in September 2009, growth rates had fallen to -11%.

As demand in travel picks up, so has online advertising for the sector. In fact, the number of display ads among airline advertisers reached 3 billion in Q2 2010, up 67% vs. year ago. Southwest remains the top display advertiser among all airlines, accounting for 20% share of voice in the category in the second quarter, followed by American Airlines (13.0%) and Continental Airlines (12.4%).

After a pretty tumultuous 2009 for many industries, it is nice to see some begin to bounce back from the recession. The online travel industry appears to be one such industry, and as online consumer spending in the sector increases, travel advertisers are allocating greater marketing expenditure to the digital channel.

But as the economy remains in a tenuous position, we can only hope that these trends will continue going forward.