Has Auto Shopping Gone Mobile?

The world is more mobile-oriented than ever before, and unsurprisingly, the use of a mobile device has become an important part of the car-buying process. Shoppers are increasingly using mobile devices to conduct a greater share of vehicle research, wherever and whenever they’d like. Accordingly, for the first time, Comscore is breaking out automotive shopping across devices.

Comscore tracks new vehicle shopper data via a proprietary database that examines online shopping behavior based on engagement with key lower funnel shopping activity on third-party automotive shopping sites, such as Edmunds, KBB, CarGurus, and Cars.com, among others, on both desktop and mobile devices.

In the first half of 2020, mobile shopping was two times that of desktop shopping. At the same time, when looking at digital shopping trends over time, mobile shopping and desktop shopping followed similar month-over-month trends.

Device Use by Automaker

Below is a look at the top ten most-shopped brands by device in the first half of 2020. Ford, Chevrolet, Jeep and Nissan drove more traffic on a mobile device than on desktop. Honda and Hyundai drove more desktop shopping. Dodge, Subaru, and Kia had more balanced shopping across devices.

Device Use by Demographics

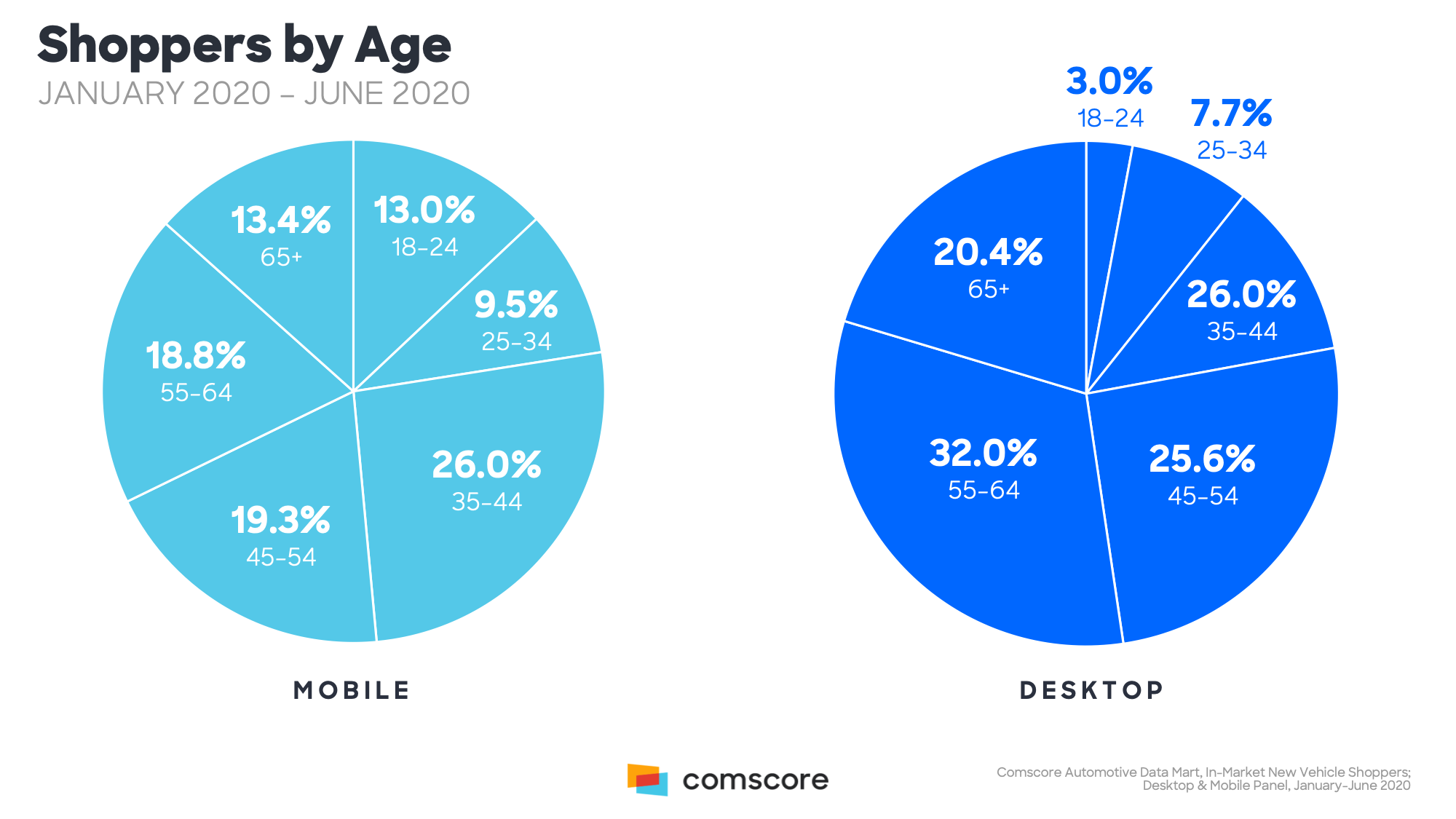

Digital shopping across devices varied by age and gender, and mobile usage skewed younger and more female than desktop.

- Mobile shoppers were younger, with a median age of 49 on mobile vs. 56 on desktop

- 23% of those using a mobile device were under 34 compared to 11% on desktop

- 49% of those using a mobile device were under the age of 45 vs. 22% on desktop

- Mobile shopping skewed more female, with 43% using a mobile device vs. 33% on desktop

Device Use by Use Case

Not surprisingly, shoppers used different devices for different purposes throughout the shopping process. Comscore’s unique ability to break out shopping by device, including individual site Key Performance Indicators (KPIs), helps illustrate the different use cases throughout the journey. For example, use of “Build Your Own” tools on automotive websites, used by shoppers to “build” or customize vehicle specifications, was seen more on desktop than mobile. This is likely because the tool requires time and effort (and clicks) to fully engage.

When we looked at the “Request a Quote” tool, we saw that it was used more on a mobile device. This suggests that it is used later in the shopping process, closer to purchase and after a shopper had narrowed down their vehicle selection. Tools such as “Locate a Dealer” and “Offers”—tools referenced as needed throughout the shopping process—saw more balanced use across devices.

To learn more about how Comscore can provide you with custom insights into media consumption contact us today.