Groupon, LivingSocial Grabbing Different Segments of the Daily Deal Marketplace

It’s hardly a secret that daily deal startups - and their valuations - are growing exponentially. In the summer of 2010, Groupon was said to be worth $1.5 billion. Months later it reportedly declined a $6 billion buyout offer from Google. Having recently filed its IPO filing with the SEC, a public offering could value it as high as $20 billion — similar to both GM and Google at their offerings. The prospects of competitor LivingSocial are similarly bright: over the course of just a few funding rounds, its valuation roughly doubled to $3 billion while gaining the support of an important strategic investor, Amazon.com.

What is behind the intense interest in these companies? Part of the excitement surrounding Groupon and LivingSocial is that they are part of the new tech boom, led by companies such Facebook, Linkedin, Twitter, Zynga, and others reportedly on the road to going public. But some question whether these sites warrant this much investor interest, or if their valuations are fueled by the rosy assumptions and optimism of a bubble yet to burst.

A Comscore analysis sought to better understand the daily deal market, its competitive environment, and how Groupon and LivingSocial are positioned within it. It found that the businesses—despite their strikingly similar concepts—reach different segments of the market and have somewhat different user profiles. We will chronicle these findings in a two-part series that will first examine their audience profiles and then investigate how they engage their customers, gain loyalty and encourage repeat usage.

Geographic and Demographic Differences between Groupon & LivingSocial

The daily deal industry is the new American West of the Internet. Stark differences in the geographic, demographic and advertising targets of Groupon and LivingSocial suggest that the sheer size and raw potential of the unclaimed market has meant that group buying businesses are engaged in a free-for-all land grab of markets and merchants. Guided by the logic that it’s easier to build a new market than to steal one away, these companies seem to benefit more from expansion rather than direct head-to-head competition.

We begin by taking a look at the geographic profile of their respective user bases. Each has a geographic strength. While LivingSocial is heavy in the East, Groupon pushes west towards the Midwest and Pacific regions. These splits may in part reflect where these two companies are headquartered, with Groupon in the Chicago and LivingSocial in Washington, D.C.

Groupon and LivingSocial also attract different types of customers. Groupon’s visitor base skews somewhat more towards younger users and females while LivingSocial’s is more normally distributed around middle-age users and proportioned roughly equally between genders.

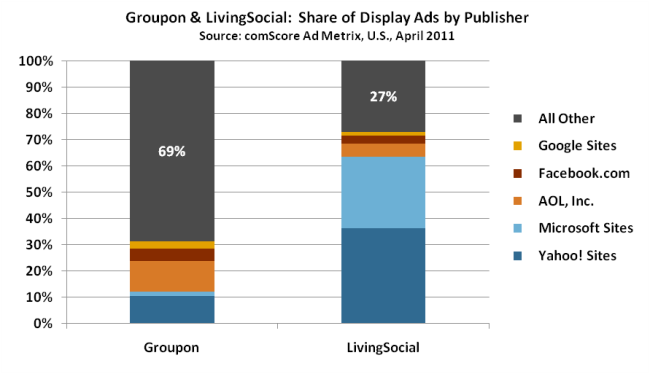

A final important aspect of this daily deal gold rush is the willingness to spend heavily on advertising to acquire customers, with the idea that investing in customer acquisition now will generate significant returns later over the user’s lifetime. Both Groupon and LivingSocial share the mindset that advertising and customer acquisition is an investment rather than expense, but they execute on this paradigm differently. LivingSocial concentrates the lion’s share (73%) of its display ads on the top five U.S. properties – specifically in news and email sections –and scatters the remaining 27% around the web. Meanwhile, Groupon’s strategy is a mirror opposite. It delivers only 31% to the biggest publisher’s sites with the remaining 69% covering a range of other publishers.

Is There Room for Competitors in the Daily Deal Market?

The daily deal industry is busy, to be sure. There are hundreds of regional and internet-based competitors in the space, with one of the newest entrants being Glenn Beck’s Markdown.com. Anyone and everyone, it seems, is trying to grab a piece of the pie. But despite the deluge of new entrants, the market is not necessarily crowded – especially at the top. The tail is long and fragmented and Groupon and LivingSocial sit as gorillas among ants, accounting for over 90% of all visits among all group buying websites tracked by Comscore. Among the top daily deal sites, we notice a significant drop-off after the top two players.

The comparatively modest email bases of niche and regional competitors suggest they are not yet mounting a serious competition to Groupon and LivingSocial. Moreover, their comparatively limited financial resources make it difficult to compete by outspending to acquire customers. There is still space in the rapidly expanding market for savvy competitors to break through and carve out a healthy position in the market, but many will likely be compelled to consolidate or turn to a differentiated, vertical-oriented strategy, such as Jetsetter’s cornering of the travel deal niche.

In part two of this post, we will examine the long term prospects for Groupon and LivingSocial based on customer growth and loyalty to help understand how this market might develop as it matures.